Introduction

Navigating the housing Current Mortgage Rates Indiana can feel overwhelming—especially when you’re trying to make sense of mortgage rates. Whether you’re a first-time buyer, a seasoned homeowner looking to refinance, or simply exploring your options in Indiana, understanding Current Mortgage Rates Indiana is key to making a smart financial decision.

Indiana’s housing market has been relatively stable, with pockets of high demand, especially in urban centers like Indianapolis, Fort Wayne, and South Bend. Mortgage rates, however, are constantly changing due to various national and local factors. Knowing where Indiana stands in 2025 can help you secure the best loan terms and make a more confident purchase.

This article provides a comprehensive look at Current Mortgage Rates Indiana, what affects them, how to find the best rates, and tips for homebuyers and refinancers in today’s economic climate.

Understanding Mortgage Rates

A mortgage rate is the interest charged by a lender for providing you a home loan. It plays a significant role in determining your monthly Current Mortgage Rates Indiana and the total amount you’ll repay over the life of the loan. Rates can be fixed (remain the same throughout the loan term) or adjustable (change periodically based on market conditions).

Fixed-rate mortgages offer long-term stability, making them a popular choice for many Indiana buyers. Adjustable-rate mortgages, on the other hand, often start with lower rates but carry the risk of future increases. The type you choose should align with your financial goals and how long you plan to stay in the home.

Factors That Influence Mortgage Rates

Mortgage rates don’t move randomly—they’re affected by a mix of national economic trends and individual borrower factors. The Federal Reserve’s monetary policy has a big impact, especially when it adjusts interest rates to manage inflation. Inflation itself, employment data, and GDP growth are other critical indicators lenders watch.

At the personal level, your credit score, debt-to-income ratio, loan amount, and type of mortgage all play into the rate you’re offered. Lenders use these details to assess your risk as a borrower. The better your creditworthiness, the more likely you are to qualify for lower rates.

Overview of Indiana’s Housing Market

Current Mortgage Rates Indiana market has been attractive for both residents and out-of-state investors. Home prices are generally more affordable compared to the national average, making it easier for many to buy their first home or move up the property ladder. However, regional variations are important. Indianapolis and suburban areas like Carmel or Fishers are experiencing increased demand, while more rural parts of the state offer more stable pricing.

New home construction has been growing steadily, especially in cities with population growth and job opportunities. Resale homes, meanwhile, remain competitive in desirable school districts and neighborhoods, leading to bidding wars in some cases.

Why Mortgage Current Mortgage Rates Indiana Differ from National Averages

While national trends heavily influence mortgage rates, Indiana’s local economic landscape can create slight variations. For example, the state’s relatively low property taxes and cost of living can make lending more favorable. Additionally, Indiana banks and credit unions sometimes offer competitive in-state loan programs or discounts for residents.

Lenders also consider regional employment rates and real estate market stability. Indiana’s strong manufacturing base and a diversified economy help keep foreclosure rates low, which in turn gives lenders more confidence in offering lower rates.

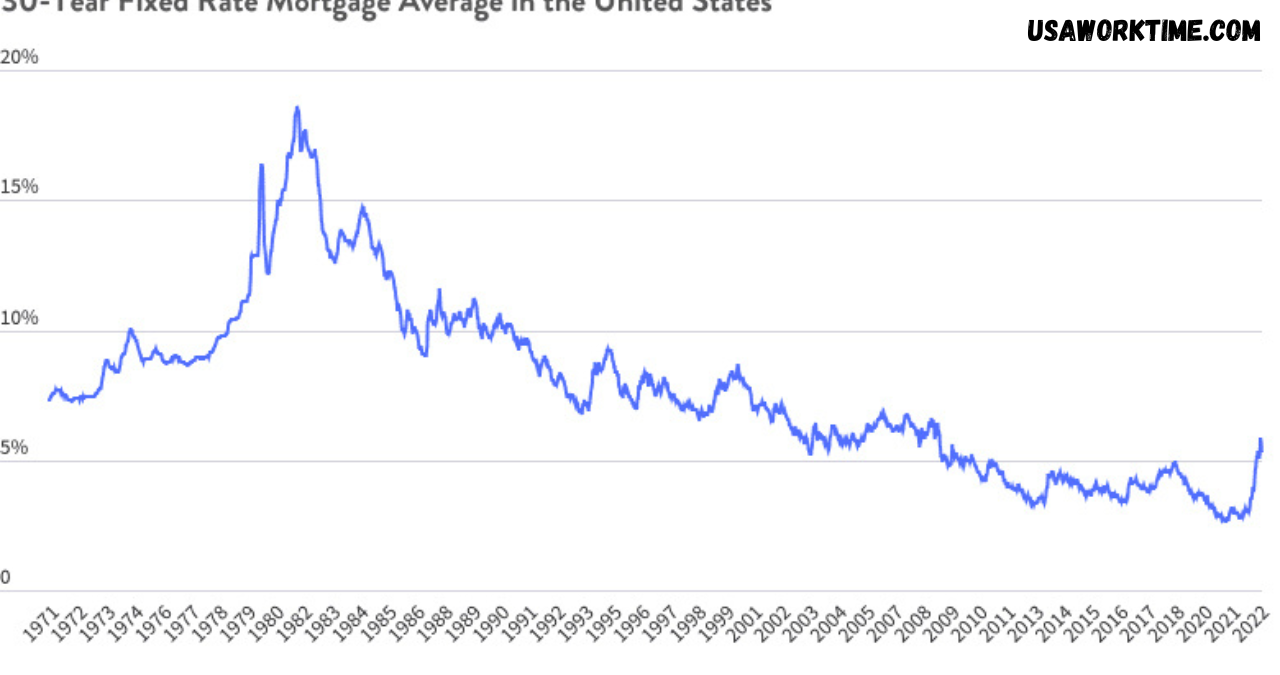

Comparison With Previous Years

Current Mortgage Rates Indiana have gradually increased compared to the ultra-low rates seen during 2020 and 2021. After reaching historical lows during the pandemic, inflation concerns and the Federal Reserve’s rate hikes have pushed rates upward. However, they are still moderate by historical standards and remain manageable for many homebuyers.

How to Find the Best Rates in Indiana

To secure the best rate possible, it’s essential to shop around. Don’t accept the first quote—request offers from multiple lenders, including local banks, credit unions, and online institutions. Use mortgage rate comparison tools and calculators to estimate your monthly payment and total cost of borrowing.

Additionally, consider getting pre-approved. This not only shows sellers you’re a serious buyer but can also lock in your interest rate for a certain period while you search for your dream home.

Tips for Indiana Homebuyers and Homeowners

The first step toward a great Current Mortgage Rates Indiana. Review your credit report and correct any errors. Aim for a score above 700 for better interest rate offers. Save for a down payment—while 20% is ideal, many Indiana lenders offer competitive rates with as little as 5% or even 3% down.

Organize key documents, such as proof of income, tax returns, and bank statements. The more organized you are, the smoother the approval process.

Refinancing Considerations in 2025

If you already own a home, refinancing might be worth considering—especially if you bought when rates were higher. Even a 1% drop in your rate can result in significant savings over time. However, factor in closing costs, which can take years to recover through monthly savings.

In Indiana, some lenders offer streamlined refinancing for FHA and VA loans, reducing paperwork and making the process quicker and more affordable.

State-Specific Programs and Incentives

Indiana offers several assistance programs through the Indiana Housing & Community Development Authority (Current Mortgage Rates Indiana). These include down payment assistance, tax credits, and special programs for teachers, veterans, and first responders.

Programs like “Next Home” or “First Place” are tailored for first-time buyers and can reduce the upfront financial burden. Local municipalities may also offer grants and low-interest loan programs, so check with city housing authorities for region-specific help.

Conclusion

Indiana remains a promising state for homeownership, offering a mix of affordability, economic stability, and housing diversity. While mortgage rates have risen from pandemic-era lows, they’re still within a reasonable range, especially for well-prepared buyers.

Understanding how mortgage rates work, what influences them, and how to shop for the best offer can make a major difference in your long-term financial picture. Whether you’re buying your first home or looking to refinance in 2025, staying informed is your strongest asset.

Frequently Asked Questions (FAQs)

What is the average 30-year fixed mortgage rate in Indiana right now?

As of mid-2025, the average 30-year fixed mortgage rate in Indiana is around 6.5%, though this varies by lender and borrower profile.

How often do mortgage rates in Indiana change?

Mortgage rates can change daily based on market conditions, Federal Reserve announcements, and lender strategies.

Are Indiana mortgage rates different from the national average?

Yes, Indiana’s rates are often slightly lower or competitive due to local economic stability and in-state loan incentives.

What credit score is needed to get the best mortgage rates in Indiana?

Generally, a score of 740 or higher qualifies for the best rates, but some lenders offer good terms with scores in the high 600s.

Can I negotiate mortgage rates with lenders in Indiana?

Absolutely. Shopping around and using multiple offers can help you negotiate a better rate or lower fees.

You May Also Read: https://usaworktime.com/retroactive-social-security-payments/